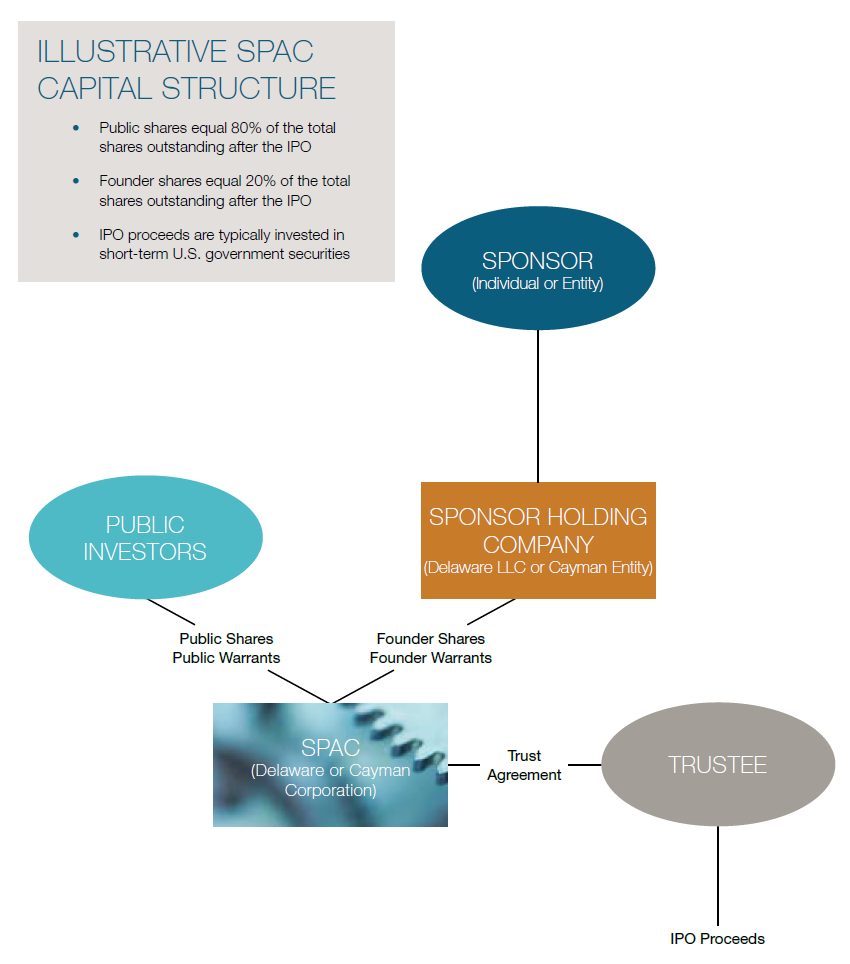

What is a PIPE investment and how do PIPE investors benefit from a SPAC deal? SPAC structures are also a compelling opportunity for companies to access a wide pool of investors through the expertise of seasoned professionals, in the form of sponsors (also refer question 17 below).įor promoters/shareholders, the potential of unlocking value for the company on a securities market and thereby receiving multiplied returns on exit could be a driving factor. More importantly, SPACs may help companies go public without being subject to complexities of the market, such as multiple investor negotiations, underwriter negotiations, valuation uncertainty and overwhelming documentations and filings. In the case of a SPAC deal, these costs are generally lower, relative to the size of the de-SPAC transaction. Regular IPO underwriter fees usually correspond to 7% of the total IPO proceeds. One of the key advantages to a target company is the reduction in time and effort to go public and the associated costs. This becomes the sponsors’ primary motivation in finding an attractive target with immense potential value.īenefit to a target and its shareholders / promoters from a SPAC deal This holding would eventually be converted into respective stake in the target’s business. After the de-SPAC transaction, the sponsor generally holds about 20% stake in the post-IPO SPAC, which would have been obtained for a relatively nominal consideration. Sponsors generally purchase equity in the SPAC at more favorable terms than investors in the IPO. Benefits to the parties involvedīenefit to the sponsor for floating a SPAC US-listed SPACs could be incorporated in the US or other jurisdictions, as US laws permit companies incorporated outside the US (for instance, Cayman Islands) to be listed on US stock exchanges. The jurisdiction in which a SPAC aims to be listed is a factor in deciding the jurisdiction in which the SPAC is incorporated.

If a SPAC is unable to complete a de-SPAC transaction within the prescribed period, the investors' money raised in the initial SPAC IPO is returned to investors and the SPAC dissolves. After a successful de-SPAC, the target company becomes a subsidiary of the SPAC or a new holding company whose shares are listed on the stock exchange. Where additional funds are required at this stage (for acquisition of target), SPACs could explore raising requisite funds from PIPE investors (refer question 9 below). Once a target is identified, the SPAC acquires the target (for example, via a consolidation/merger) in a transaction commonly referred as the “de-SPAC” transaction. The money raised by the SPAC in the IPO is held in a trust until the business combination is completed.

The sponsors/management team of a SPAC register the SPAC shares with the Securities and Exchange Commission (SEC) and undertakes a pre-IPO roadshow (presentations to potential investors) and raises capital in a SPAC IPO in exchange for the issuance of SPAC shares that are listed on a stock exchange, commonly at US$10 per share.

Spac transaction professional#

Sponsors become the public face of a SPAC, as investors essentially entrust funds to their professional judgement/expertise. The founders of a SPAC are known as its sponsors. SPACs are typically floated by experienced management teams with well-established track records who understand the industry or the relevant market segment. A SPAC is required to complete the business combination with one or more private businesses within the time specified in its charter documents (usually within 18 – 24 months).

Money is raised with an objective to identify attractive private companies (with high growth potential) which can be acquired and taken public. We look at what constitutes SPAC and what businesses should know.Ī SPAC is formed to complete a merger, acquisition or similar combination with one or more businesses, that is identified after raising money from public investors by way of an IPO and listing, typically on a US stock exchange. The concept of Special Purpose Acquisition Company or SPAC has become very popular in the Indian business landscape in recent times.

0 kommentar(er)

0 kommentar(er)